The Meno Approach To Trading

There are many ways to make a living - one of them is stock trading. Similarly, there are many ways to trade, and any trader who hopes to be successful must spend time and effort developing their specific trading approach. Here we will outline the main approaches to trading and explain why The Meno Project will focus on a scientific approach that is abstracted from underlying company fundamentals.

We discussed the difference between investing (using fundamental analysis of companies) and quantitative trading (using technical analysis of price action) in What is Quantitative Trading?, but not why we're focused on the latter.

Investing in companies using fundamental analysis (the Warren Buffett approach) presents two very large challenges. Firstly, fundamental data is difficult to quantify (how do you put a price on good leadership?), and therefore measuring a company's "true" value becomes a deeply subjective task. The second, and even stickier, issue with traditional investing is that it assumes that the market prices a company's stock based on its fundamental value. However, trading has always been a speculative endeavor, and therefore a stock price often deviates greatly from what it "should" be based on traditional methods of pricing a company's stock based on its performance. You don't have to search far to find stocks that are priced based on assumed future performance that has only the thinnest possible correlation with the company's current performance. While some individuals and institutions have done quite well using traditional investing approaches (particularly with very long-term strategies), it's very difficult to view the market as a mechanism that fairly prices stocks based on company fundamentals.

The early inventors of technical analysis (including Charles Dow, founder of The Wall Street Journal and the Dow in Dow Jones) understood this problem and solved it by fundamentally changing how they viewed the market. They knew that trading is a human endeavor and is therefore dominated to a large degree by emotion - people trade based on fear and greed, not necessarily what makes rational sense given a company's performance. Therefore they viewed stock price as reflecting trader's sentiment about the company, as opposed to reflecting company performance itself. This is a second-order approach, as the trader is no longer trading based on the performance of the companies themselves, but on the market's view of the companies.

This approach was codified in the Dow Theory and numerous other frameworks of technical analysis - instead of explaining price action by company activity (e.g. earnings), we instead talk about trader activity. In this view market trends are caused by traders trying to profit from the greed and fear of others, and successful traders are ones that can anticipate stock trends based on the market's opinions and expectations. Sentiment-based technical analysis presents a more accurate model of the market behavior, but also one that is abstracted away from the economic realities of any particular company.

This second order framework is currently the prevailing approach for quantitative traders, particularly individual traders, but even it fails to completely capture market behavior. This failure is largely due to Wall Street's recent focus on high frequency trading and various arbitrage methods which seek to profit purely from inefficiencies in market infrastructure. This approach isn't based on a model of company fundamentals or of trader sentiment - they are simply exploiting the physical limits of the computer hardware that makes up the market. Consequently, institutional trading can cause price action to have large, seemingly random movements, particularly on short time intervals. This institutional approach requires very specialized hardware that isn't feasibly available to individual traders. Without this option, individual traders are forced to develop an even more abstracted model of the market in order to make sense of all the forces impacting price action.

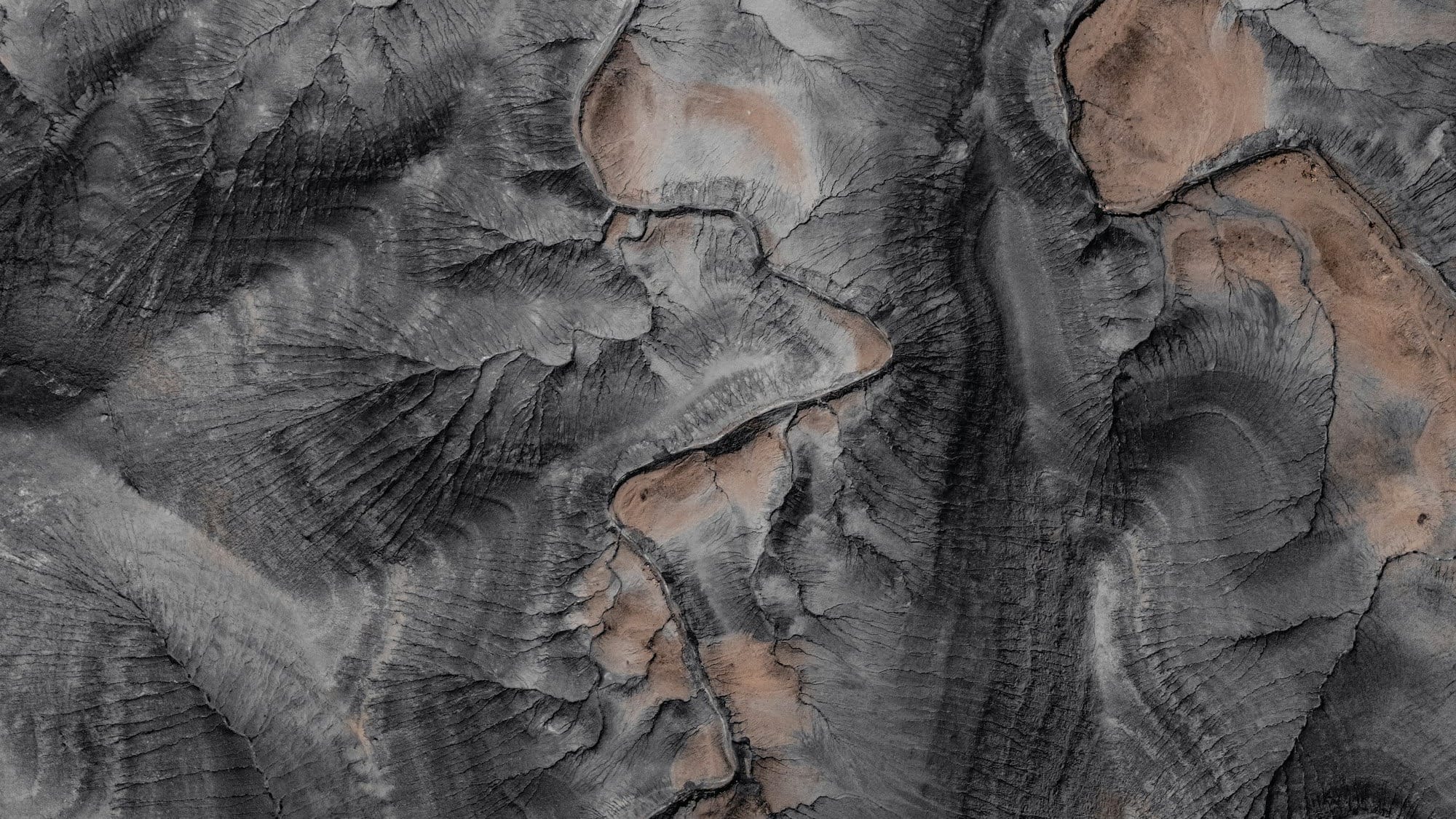

Looking at the price chart of even a very well established stock, one would be forgiven if all they saw was random noise. Price can often seem like a billiard ball being knocked around at the whim of unknowable forces. Some traders have taken this view to heart and come to the conclusion that modeling the market based on any meaningful real-world activity (i.e. company performance or trader sentiment) is infeasible, and have instead began to view the market as something analogous to a physical system. This has given rise to a whole field of research called econophysics, which applies concepts and techniques from physics to finance. Traders have applied physical concepts from classical, statistical, and even quantum mechanics to model market behavior. In fact, the main formula used to price stock derivatives, Black–Scholes model, is derived from the equations physicists developed to describe Brownian motion (the random motion of particles in a fluid). Econophysics and its application to trading is a promising but still young field, and since the market isn't actually a physical system, the connection between a stock's price action and physical principles are necessarily by analogy. This poses obvious challenges as to how exactly to construct these analogies, but it also provides an opportunity for creative interpretations of physical principles. Approaching trading through this physical lens leads to a completely abstracted model of the market, where price action is no longer connected to any real underlying force. This allows, perhaps unintuitively, for a potentially much more accurate view of the market, and therefore a much greater ability to predict future price action.

The Meno Project will adopt this approach in the broadest possible sense - using concepts from physics, as well as other sciences, to model market behavior. Our aim is to explore this scientific paradigm of trading and use it to develop concrete strategies. We can then test these strategies through trading just as scientists test their hypotheses. The ultimate goal is to develop a deep understanding of both market behavior and scientific principles.